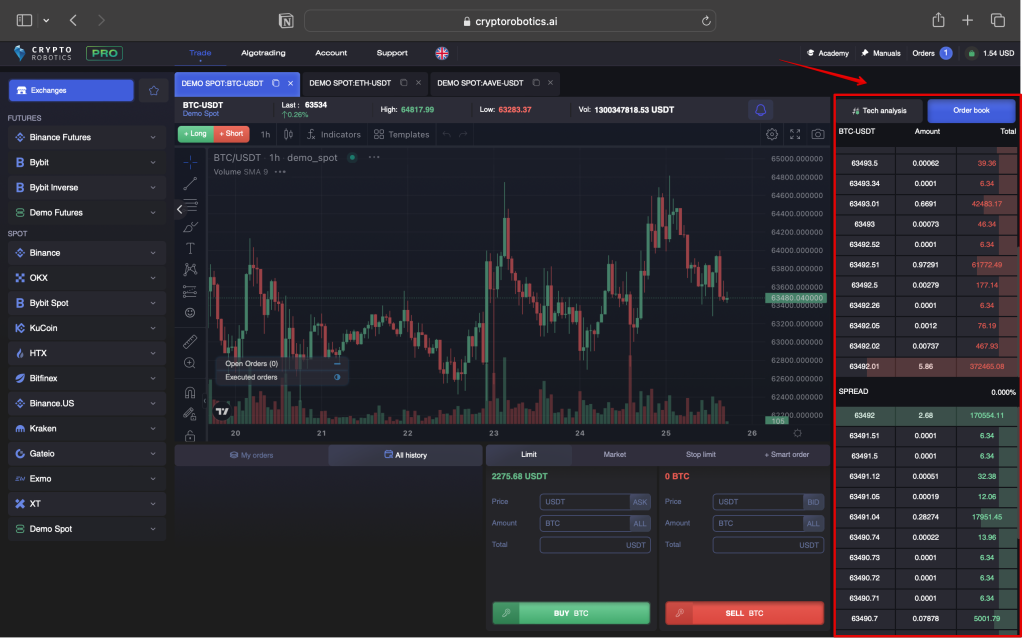

Order Book is displayed in the right side of the terminal.

In the upper bar you’ll see «ask» orders (sellers) , at the bottom «bid» orders (buyers).

The first column shows the price level of the asset, the second shows the volume of the coin to be bought, the third shows the same value only but only to the coin to which we trade.

Thus, you can see the volumes in each price range.

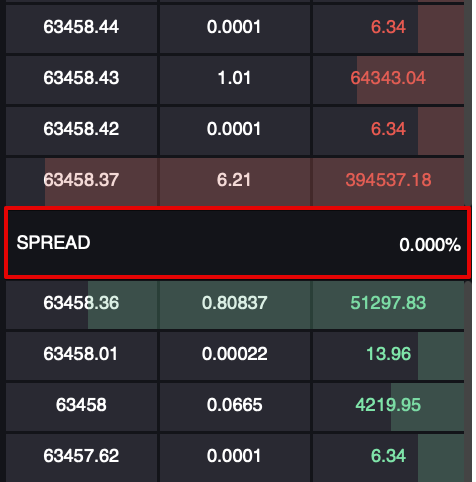

The difference between the closest bid order and the closest ask order is called — Spread. It is displayed as a percentage.

The size of spread for a particular asset depends on many factors: the amount of supply, the amount of demand, volatility and activity in the market. As a rule, the more transactions there are in a particular asset, the lower the spread is and vice versa.

The spread is usually high (from 1% and up) for not liquid coins with low trading volume. This means that when you buy an asset you are obviously already at a loss, as prices in the ask Order Book are higher than in bid Order Book. You need to understand and track it.