In this tutorial, we will explain how to set up futures robots. These robots, unlike others, trade both long and short positions. That is, they bring profit both in a growing market and in a falling one, and also allow users to choose a leverage for trading.

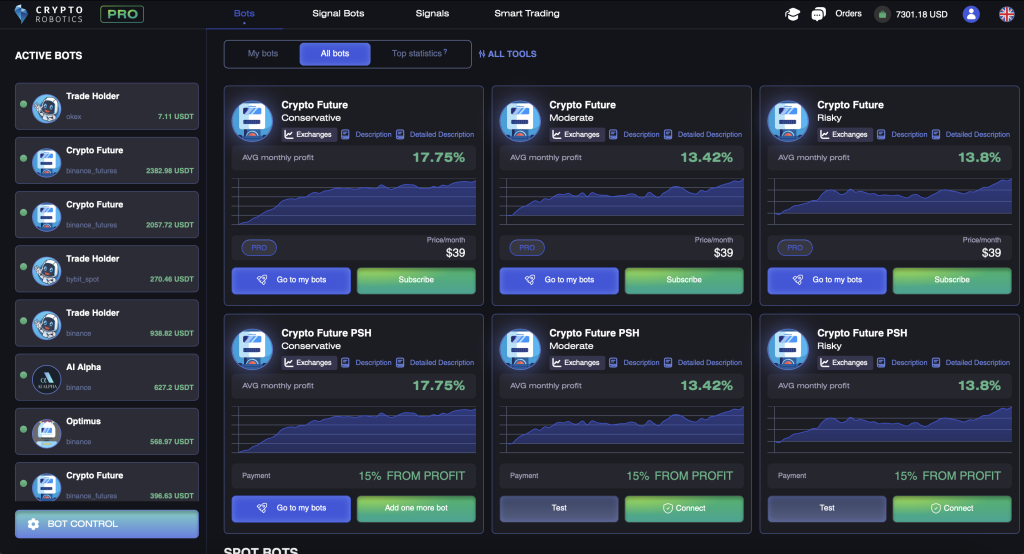

First, go to the Bots tab-> All bots section.

There are three futures bots, and they differ in the level of risk when trading, depending on the set take profit and stop loss levels. There are conservative, moderate, and risky options. That is, in the conservative version of the strategy, Take Profit and Stop Loss are set to a minimum, whereas the maximum ones are set on the bot with a risky strategy.

Any of Crypto Future bots can be connected either for a fixed subscription fee (from $39)

or via the Profit Sharing system — for 15% from profit.

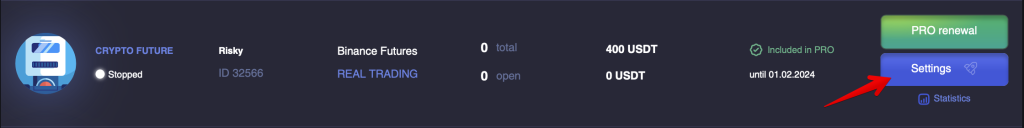

Let’s take a closer look at one of the futures bots. Click «Connect» in the All Bots tab

or go to the My Bots tab and press the «Settings» button.

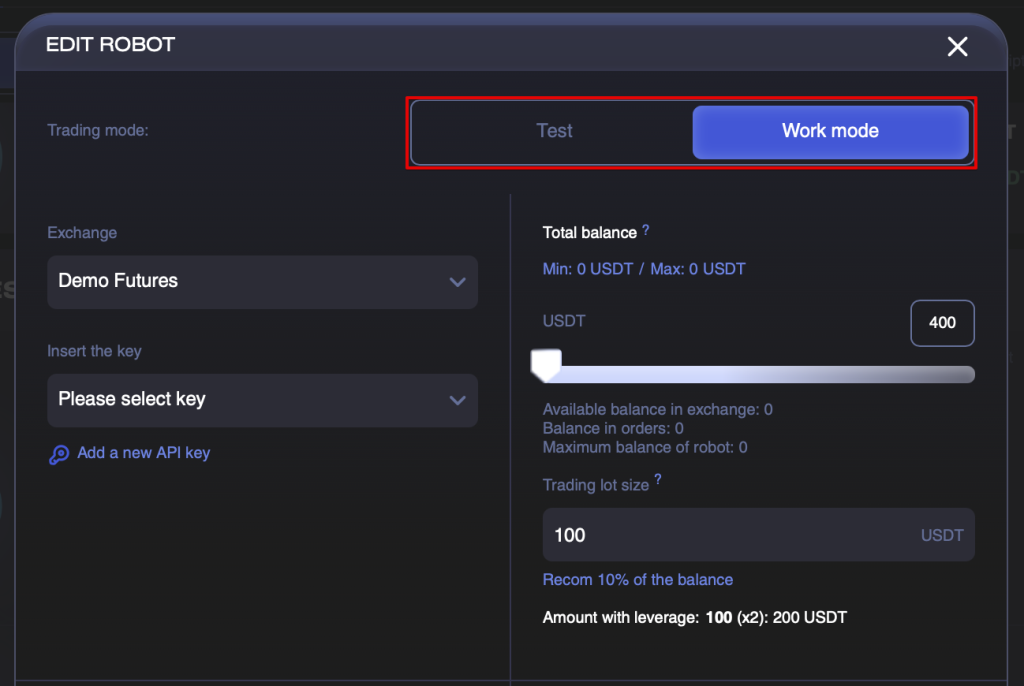

A window opens displaying the parameters and settings of the bot. There are two modes available: test mode and work mode.

If you haven’t run such bots yet, you can run it in test or demo mode. In this case, the bot will enter into the real order trades directly according to the chart, taking into account the order book, but without affecting your balance.

The bot is available for test on any of the packages, including the FREE one.

Test period lasts 14 days from the moment the bot is added to the My bots section.

If the bot was added to the system by you more than 14 days ago or was already included in the paid package, it will not be available for test on a FREE package.

Let’s run the bot in test mode, for this you need to select the work mode and go to the settings.

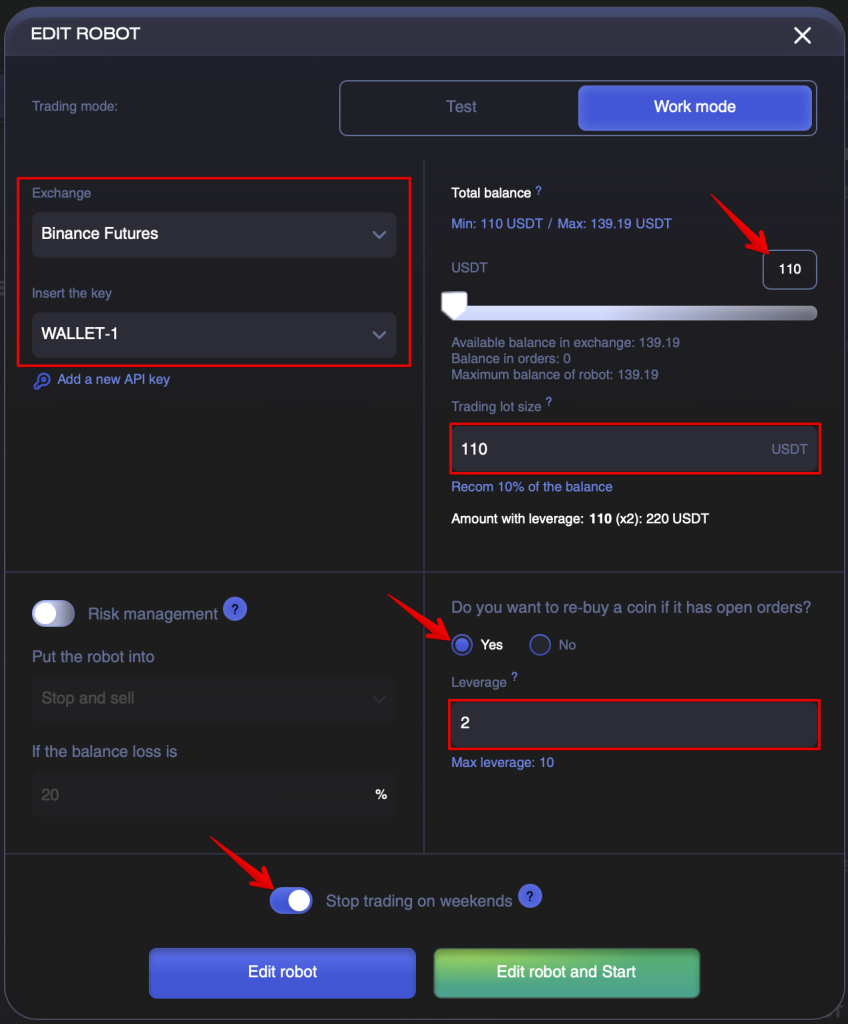

The first thing we do is choose an exchange: Binance Futures or Bybit UTA Futures. Keep in mind that in order to connect the Binance and Binance Futures exchange accounts, it is necessary to pass verification on these exchanges themselves before linking them via the API.

Next, select one of the keys or accounts. You may have several of them.

Then, we need to select the balance for trading and the lot amount.

After that you can choose whether you want the bot to re-buy the same coin if there are open trades on it already and set the leverage for trading

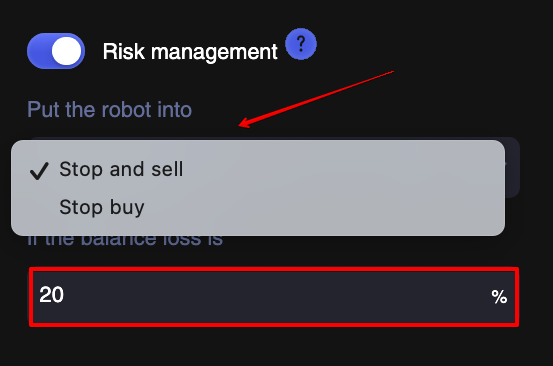

In case there are unexpected market fluctuations that can lead to a strong drawdown of your deposit, you can specify the maximum percentage of loss. That is, in the risk management section, you can select the option to stop and sell everything or just stop buying if your balance starts to fall below the specified percentage.

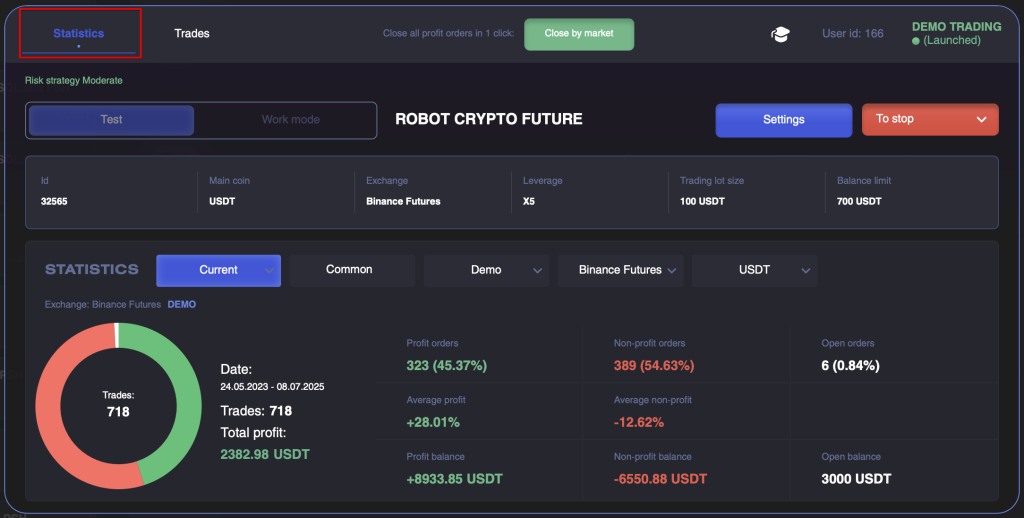

The Statistics section will display all statistics for the running bot. These are the percentage of profit order, and non profit orders, the average profit, the average loss and the balances of profit and loss.

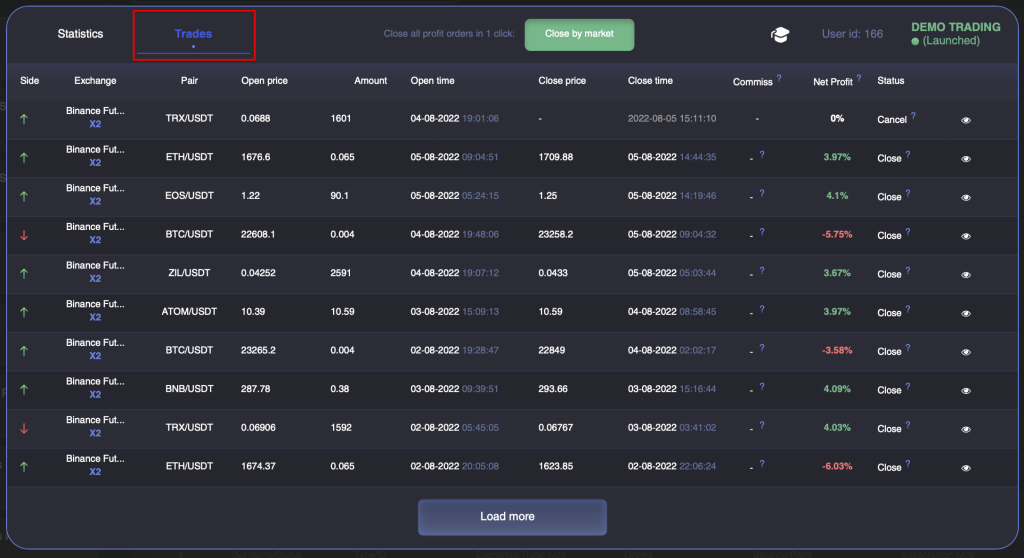

You can also go to the Trades section, where both closed and open deals will be displayed. Also, there is information on the exchange, currency pair, opening prices, opening time, closing prices, closing time and its status, profit on both closed and open orders in real time.

Crypto Future is a trading bot based on technical and mathematical analysis. Its strategy is based on the principles of channel trading, based on the price movement inside the channel from strong levels.

The bot trades TOP 10 crypto pairs:

BTC/USDT

ETH/USDT

BNB/USDT

ATOM/USDT

ZIL/USDT

XRP/USDT

TRX/USDT

LINK/USDT

ADA/USDT

EOS/USDT

The list of coins for trading is subject to change.

The bot analyzes historical data and finds the maximum and minimum extremum points, on the basis of which it builds price levels, which are support and resistance lines. The boundaries of these levels are the trend reversal points. Breaking through, fixing above or below the channel borders, as well as a price rebound from the lower or upper border of the channel signals a change in trend.

The bot additionally predicts a trend change using a variety of auxiliary technical indicators, such as ma, rsi, stochastik, which confirm the trend changes at the channel boundaries.

After the bot has found an entry point, it automatically calculates and sets targets for Take Profit, and also calculates Stop Loss to limit losses.

The bot provides signals on market reversals down and up, respectively, if you notice that the bot does not open new deals for a long time, you need to understand that it is waiting for a reversal, after which trading will resume.