Copytrading is a service that broadcasts in real time the trader’s operations directly from the exchange and allows users to automatically copy trading orders in equal proportions of the total trading balance.

Master is a channel managing trader who trades on his own exchange account.

The service is available on 2 exchanges: Binance, Binance Futures

If the Binance Spot Exchange is enabled, futures trading will not count. If the Binance Futures exchange is enabled, only trading on USDT perpetual futures will be counted. Trades on other types of futures and spot will not be counted.

Before launching the channel, you need to set the basic parameters:

- Exchange,

- Main currency,

- Minimum balance,

- Deviation from min. balance

- Trading Mode (One-Way/Hedge)

You can choose only one main currency (BTC/USDT/ETH) which will be traded on one account connected for copy trading. Orders to other main coins won’t be used by system for copy trading.

The minimum balance is required to avoid the following situation: the user’s order is less than the minimum lot on the exchange in the traded currency. It is calculated based on the total trading balance on the master’s account and the planned minimum order amount (including additional purchase and averaging). The user’s balance should be enough to create an order; the doubled minimum lot is taken for calculation.

Minimum balance calculation:

- 2,000 USDT — the total balance on the master’s account. (all the coins on the balance are taken into account and the total balance is considered in the equivalent of the main coin, in this case USDT)

- 100 USDT — the minimum amount of one order, which the master plans to place

- 10 USDT — minimum lot size on Binance (spot)

The formula for calculating the size of 1 order in proportion to the total balance:

Min. master’s order / master’s total balance

The formula for calculating the total minimum balance:

Min exchange lot size * 2 / size of 1 order

Calculation example:

100 USDT * 100% /2,000 = 5% (size of 1 order)

(10 USDT * 2) / 5% = 400 USDT (min balance). Please make corrections to the potential balance drawdown (we count the maximum drawdown of 20%).

The minimum balance is specified in the user settings of the channel, preventing the connection of exchange accounts with insufficient funds.

Proportions:

The users’ orders are created in equal proportions, where the total balance of the user’s account and the total balance of the master trader’s account are taken as 100%.

The entire balance of the account in the equivalent of the main coin is involved in the calculations, and not just the amount of this coin on the balance.

If the master has created an order for an extremely small amount, in which, in proportion, the size of the user’s order is equal to the amount less than the exchange minimum, then the following mechanics will be applied in trading:

- if this is an order to gain a position, then the order, where the lot amount is less than the minimum, will be skipped by the user. Otherwise, it would be necessary to increase the amount to min. lot and change proportions;

- if this is an order to reduce/close the position, then the lot amount will be increased to the minimum of the exchange, and the position will be reduced. Since the reduction of positions is a priority task of the system, in this case the system will increase the lot amount to the maximum possible.

- additional check of the user’s balances: if the master reduces the position by a certain percentage, for example, by 70%, but the user’s position balance (30%) is less than the exchange minimum, and the system will not be able to close such a share in the future, then the share will be increased, and the user will have 100% of the position closed.

Users undertake to connect clean exchange accounts, which do not conduct manual or automated trading except the copytrading of the connected channel. A separate account must be connected for each channel.

Trading mode: one-way mode, hedge mode

When creating a channel, you should specify the trading mode in accordance with the settings on the exchange. If you try to connect a master account with a hedge mode to a channel that has one-way mode enabled, trading will be prohibited.

All users connecting to the channel should have the corresponding trading mode enabled. If the mode does not match, copying trades and trading will not be carried out.

Adjustment of master positions in the system:

During the initial connection: if at the time of the first connection a master trader has open positions on the exchange, they will be nominally copied into the system for further tracking, gaining and reduction.

Important! Users will not have open positions created by the master trader before joining the channel. If, after connection, the master trader reduces the previously opened position, the user’s positions will not be reduced (the user skips the positions opened before his connection). The user will have trading only when the master trader starts to gain a position.

When connecting and restarting the master trader’s trading account to the channel, open positions in our system and the master trader’s open positions on the exchange are checked. If there are discrepancies in our system, additional positions will be opened and positions that the master trader no longer has will be closed.

Users will have their extra positions closed (already closed by the master trader), new positions (opened when the channel is off) will not be copied to the users.

User balance adjustment:

The balances of all users connected to the channel are regularly checked against the master trader’s current open positions. If there are open positions on user accounts (or coins on the balance) that do not correspond to positions in the channel, they will be automatically closed/sold. New positions (opened by the master trader before the user connects or when the channel is turned off) will not be opened for users.

Correction is carried out:

- when a user connects to a channel (individually for this user);

- when the channel is started/restarted by the master trader (for all connected users);

- once every few days prophylactically (for all connected users);

This adjustment allows to quickly solve the problem of discrepancies in the positions of the master trader and the user. If the master trader noticed a discrepancy, it is enough to restart the channel, the extra positions will be reduced.

Principle of copying:

Only executed orders enter the system, as a result of which a position was opened or closed. Open, canceled orders, exchange stop losses are not sent to the system until they are executed.

For users, all orders are opened at the market (at the current market price). In mass trading, only this type of orders allows to achieve 100% execution for all users.

Orders creation frequency limit:

For proper copying of orders to all connected user accounts, it is necessary to pause between orders for at least 30-40 seconds. Higher frequency trading can lead to errors and creation of orders by users with significant delays, respectively, the price of entry/exit from a position may differ from the master trader’s one.

The specified time is necessary for carrying out checks and calculations, sending requests to the exchange, and receiving the operation success status. They are:

- user balance request;

- calculation of the proportion coefficient, calculation of the amount of the user’s order;

- request for the current leverage, reconciliation of the leverage with the leverage of the master trader, change of leverage in case of discrepancy;

- trading mode (one-way or hedge);

- sending an order to the exchange;

- obtaining the exchange status of an order, fixing an order in a position in the system, etc.

In high-frequency trading, users orders are queued. The execution of the next order occurs only after the successful execution of the previous one.

It should be taken into account that this is a mass trading service, and in his trading strategy, the master trader should remember that he is followed by a large number of users. It is necessary to maintain certain time intervals so that not only the order of the master trader, but also the orders of all his followers have time to be executed on the exchange.

Before starting trading, it is recommended that you study with all the trading mechanics of the Copytrading service. They describe the behavior of the system in non-standard situations:

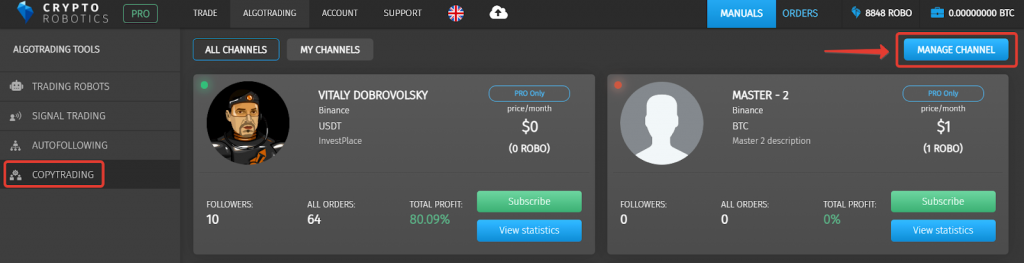

Channel setup and launch

Management is carried out in the Manage channel section

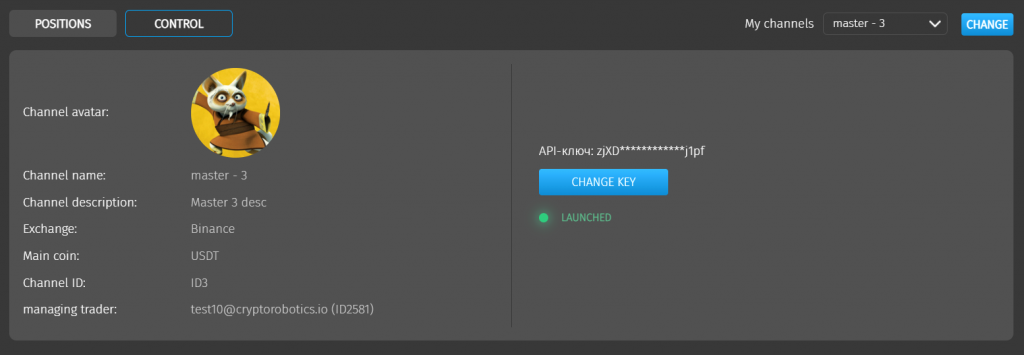

There are 2 sections: Positions and Control.

To launch the channel, you need to choose Control section and connect the API key of the exchange account where trading will be carried out.

Attention! When the API key is connected, the channel will be automatically launched and the broadcasting will begin.

It is necessary to monitor the functionality of the key to avoid losing the connection. If the API key has become inactive, it must be urgently reissued and replaced by clicking the Change key button.

Setting of an available channel for users

After launch, the channel is in hidden mode for collecting statistics and testing. The channel is visible only to the owner and administrators. To release the channel to the public, you need to contact the manager and enable the public access mode.

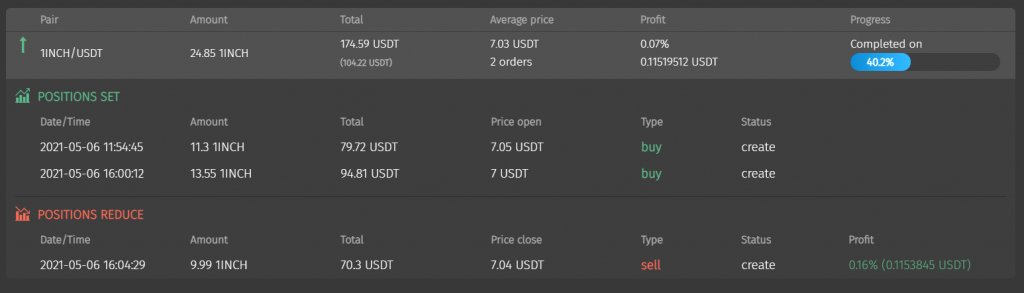

Positions

All trading operations performed on the account are broadcast to the channel and collected in Positions. One position is equal to all orders for one currency pair for the entire trading period since the start of copytrading in the terminal.

The position is divided into 2 parts:

- Positions set (all buy or open orders)

- Positions reduse (all sell or close orders)

General data is displayed at the top of the position:

- total number of the coins set in a position

- total amount in a main currency

- current balance in a main currency

- average open price

- number of orders to be open

- total profit in percentage and in physical term

Each close order has a profit, which is calculated as the difference between the Average Open Price and the Close Price of this order.

The total profit is calculated as the weighted average of the profits of all orders to be closed.

The progress of completion is displayed for each position. A position is considered closed if the total amount of open orders matches the total amount of close orders.

Copying orders on user accounts

After the user connects to the channel, the system filters open and close orders, and duplicates only orders for opening new positions on the user’s account in order to avoid selling coins that have not yet been purchased by the user. Thus, the positions for new open orders are created on the account, and the master can continue to reduce and close previously opened positions.

The order is created in equal proportions, where the total balance of the user account and the balance of the master account are taken as 100%. The calculation involves the entire account balance in the equivalent of the main coin, and not just the amount of this coin on the balance.

In the user’s personal statistics, all orders are set in positions, similarly to those of the master.

Leverage selection:

When trading on the Binance Futures exchange, the user’s orders are open with the same leverage as the master’s ones.

Displaying public channel statistics

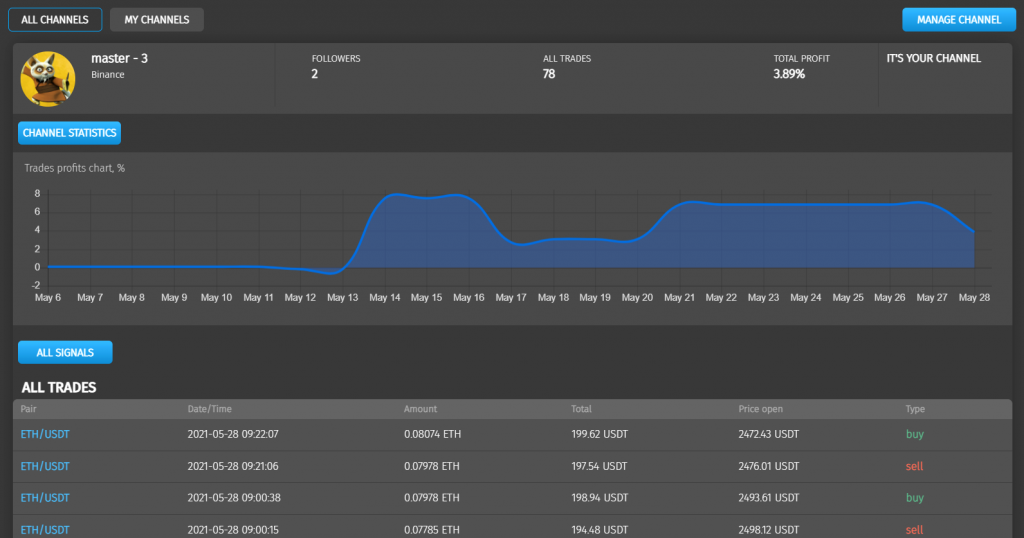

Users have access to the Trades profits chart, which displays the cumulative profit for each day for the entire trading period.

A list of trades on the channel is also available to users; it is displayed with a 24-hour delay.

Orders set in positions are not available for the public access, since different users may have a different number of positions.

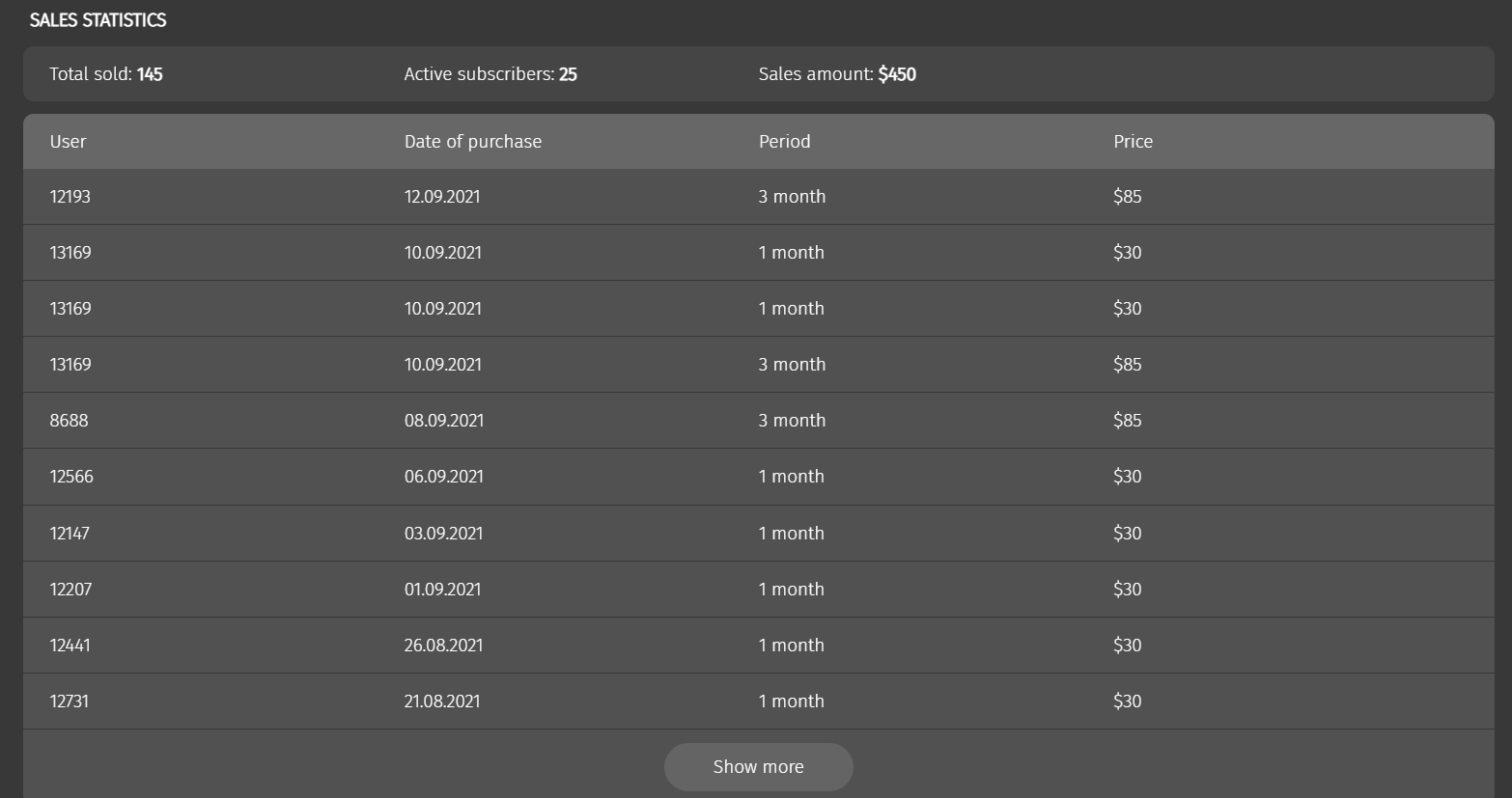

Displaying statistics on channel purchases

A list of all purchases can be found in the Manage channel section, in the Control tab

The following information is available:

- The total number of sales;

- Number of active subscribers;

- The total amount of sales;

A table with a list of all subscribers is also available. It contains:

- List of subscribers with their user ID in the system;

- Date of purchase;

- Subscription period;

- Subscription cost.