Cryptorobotics Autofollowing is the automation of your trades, the service is configured once, then you only collect statistics and profits from trades.

Autofollowing is a «signals+robot» service. The signals are provided by the analyst, the robot processes the signals and makes trades.

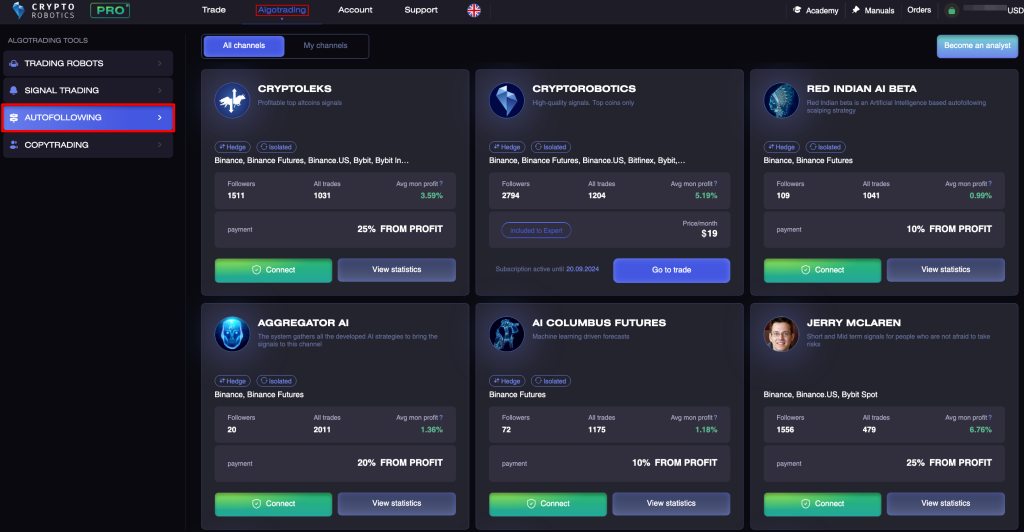

To start using Autofollowing, go to the Algotrading section and select Autofollowing in the left menu.

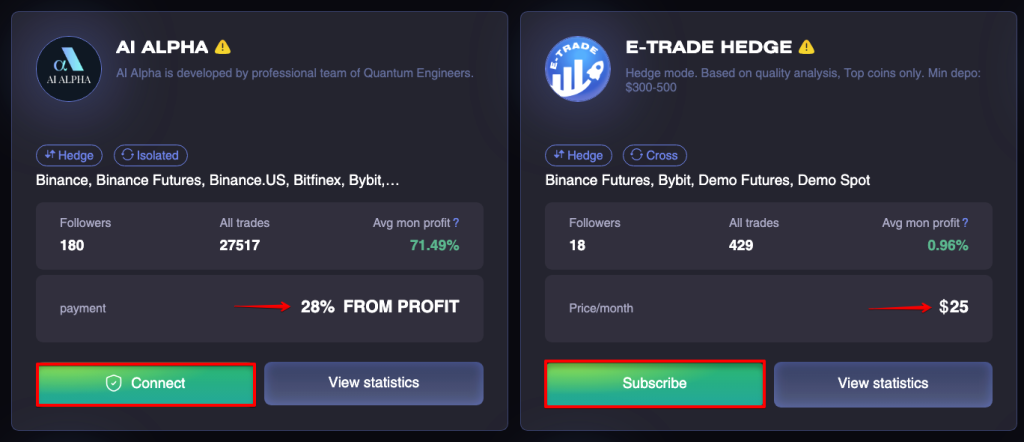

In the window that opens up, you will find several channels, for each of which you can see summary statistics:

- cumulative return;

- number of signals/trades for the entire period;

- exchanges for which signals are received;

- number of subscribers;

- the subscription price per month / Profit Sharing %.

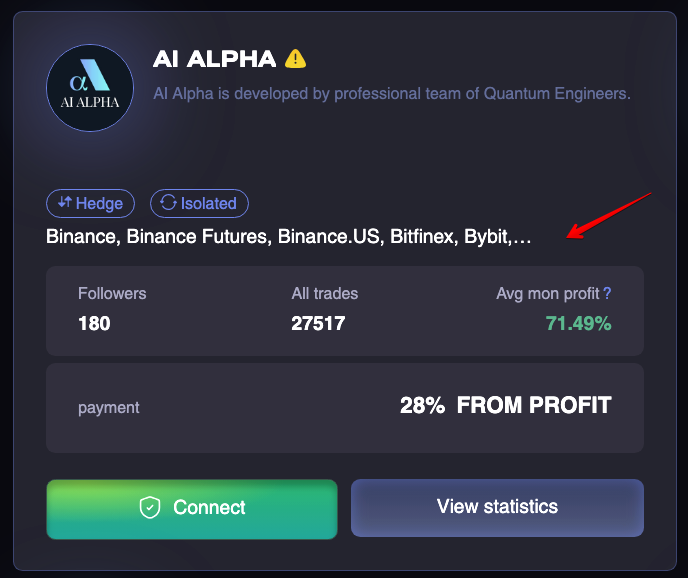

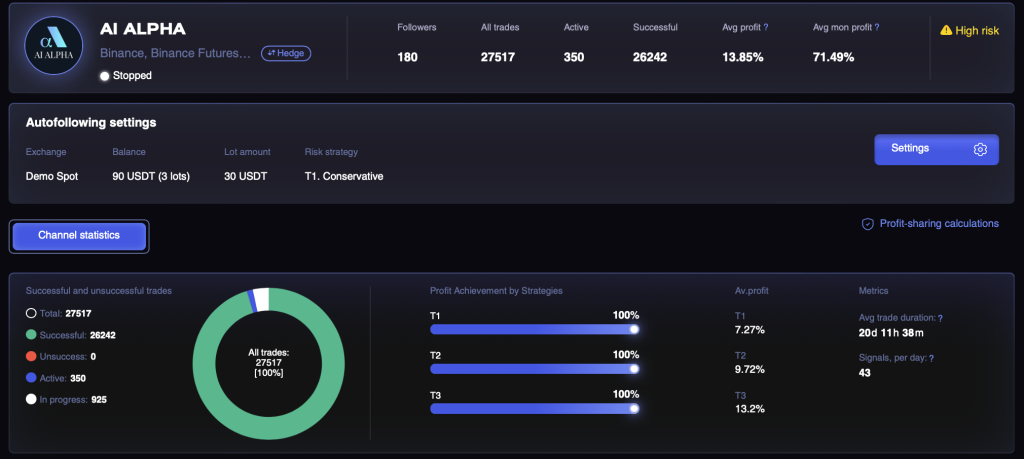

In order to get more detailed information about the channel statistics, you can select the View statistics button, after which you will be taken to the channel page, where data from the channel cover is presented, as well as:

- average profit on a signal/trade — average profit value on a single signal.

The average profit of one signal (for the last year) = the sum of the maximum achieved profits of all completed signals for the last year / the number of completed signals for the last year; - Win/Loss percentage chart;

- achievement percentage for each of the strategies: conservative, moderate, risky;

- average profit for each strategy;

- average trade cycle and average number of signals per day;

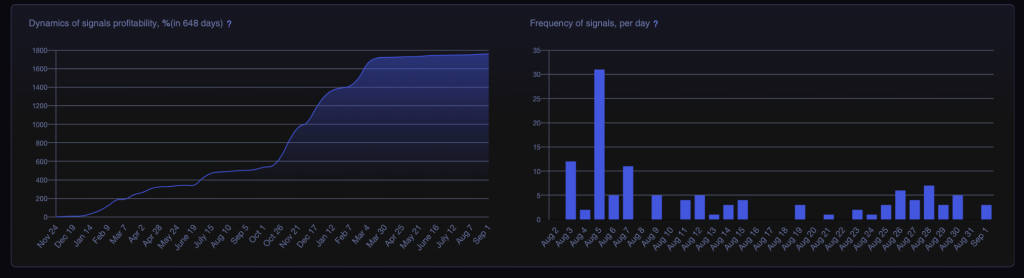

- chart of cumulative profit growth from signals/trades in the channel — the chart displays the cumulative value for each day: all maximum targets reached for the day / recommended number of lots. Only completed targets are considered in the calculation of signals’ profitability.

- chart displaying the frequency of signals received in the channel.

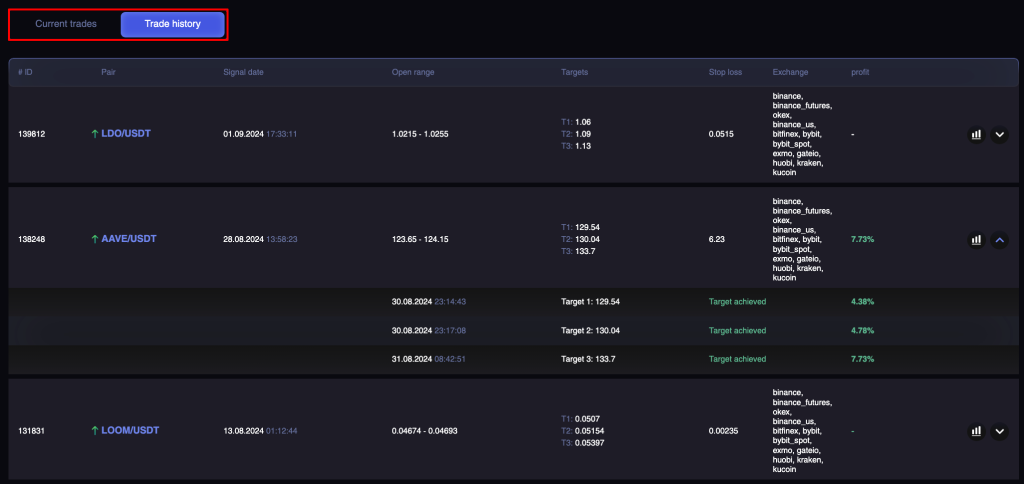

Below you can find the statistics of each of the signals. They contain such data as:

- date when the signal was created;

- targets achievement and profit for each of the 3 strategies;

- date and time of trades for each strategy;

- exchange/s where the trade was made;

- a chart that shows all the signal parameters: buy range, strategy targets, stop loss. You can track the time of the trade on the chart, as well as track where the price is now in relation to the sell target for pending signals;

- the status of pending signals is also displayed.

In order to connect the Autofollowing service to your account, you need to:

- select the channel you are interested in,

- click the «Subscribe/Connect» button”,

- pay for a subscription / connect via the Profit Sharing system.

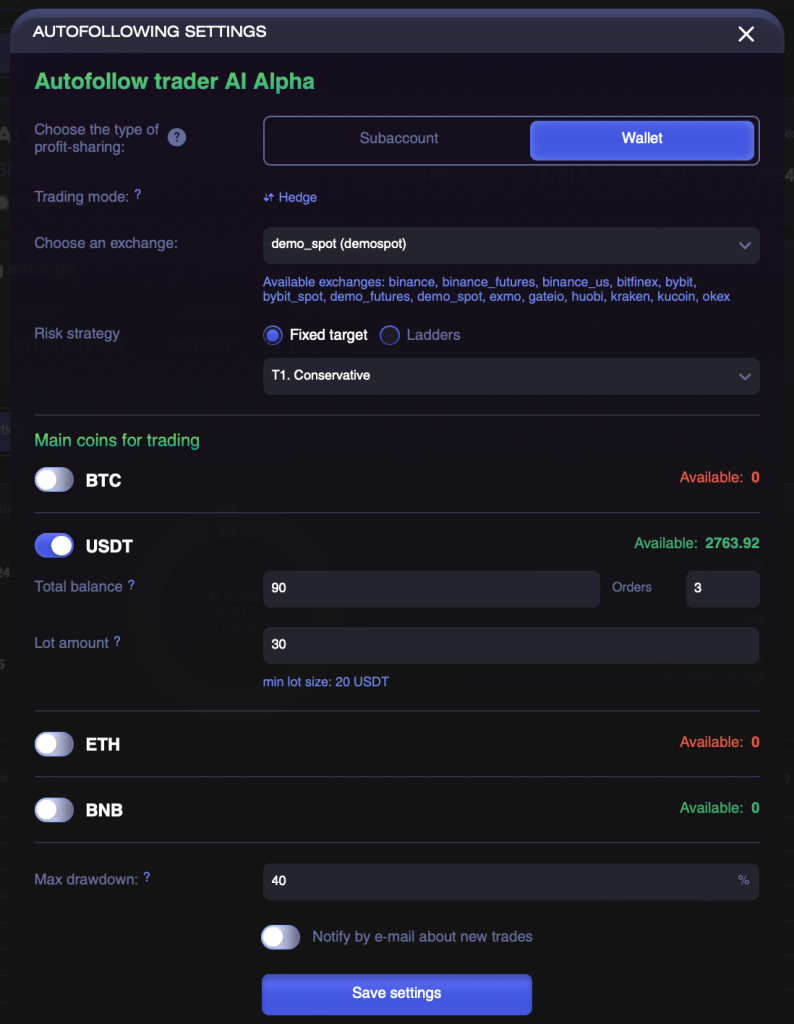

Once you have subscribed to a channel or clicked Connect, the channel settings become available to you.

If you have selected a channel that works via Profit Sharing, the settings window will open automatically after clicking on the Connect button.

In case you have selected an Autofollowing channel with a fixed subscription, you need to click the Settings button.

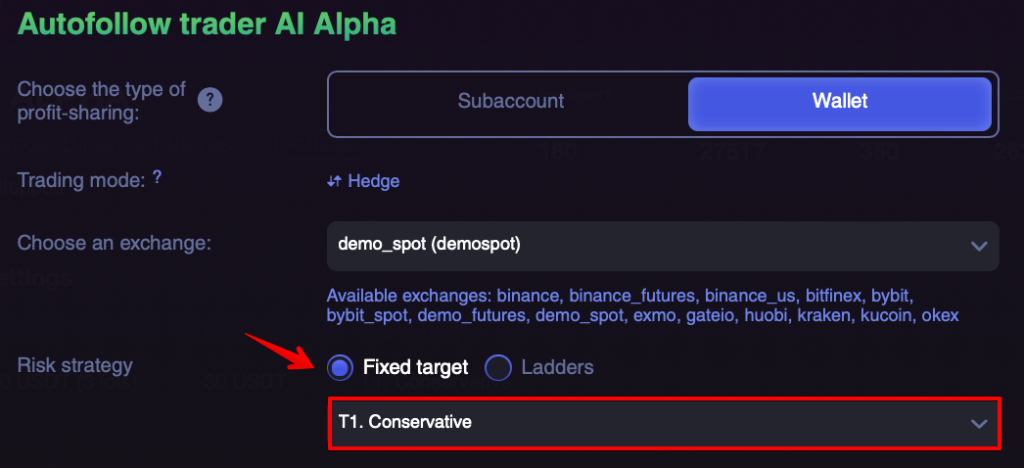

Let’s review the parameters of the Autofollowing settings.

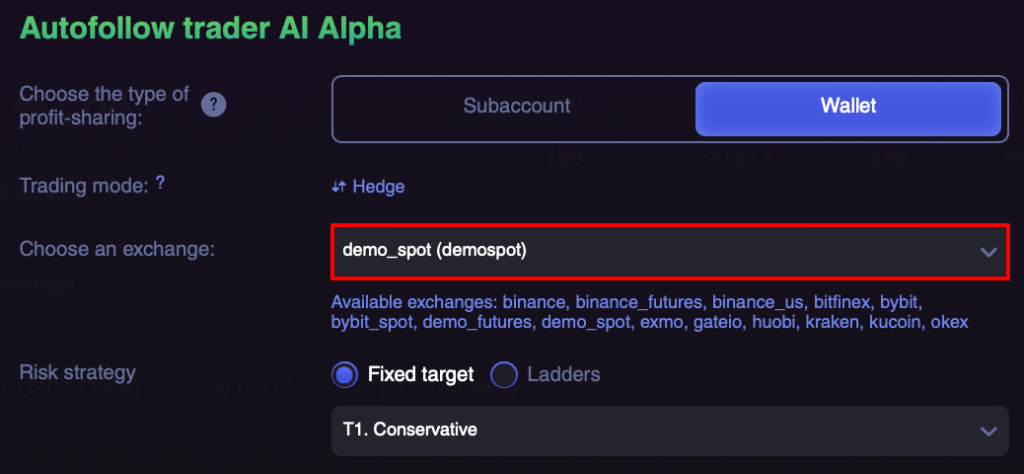

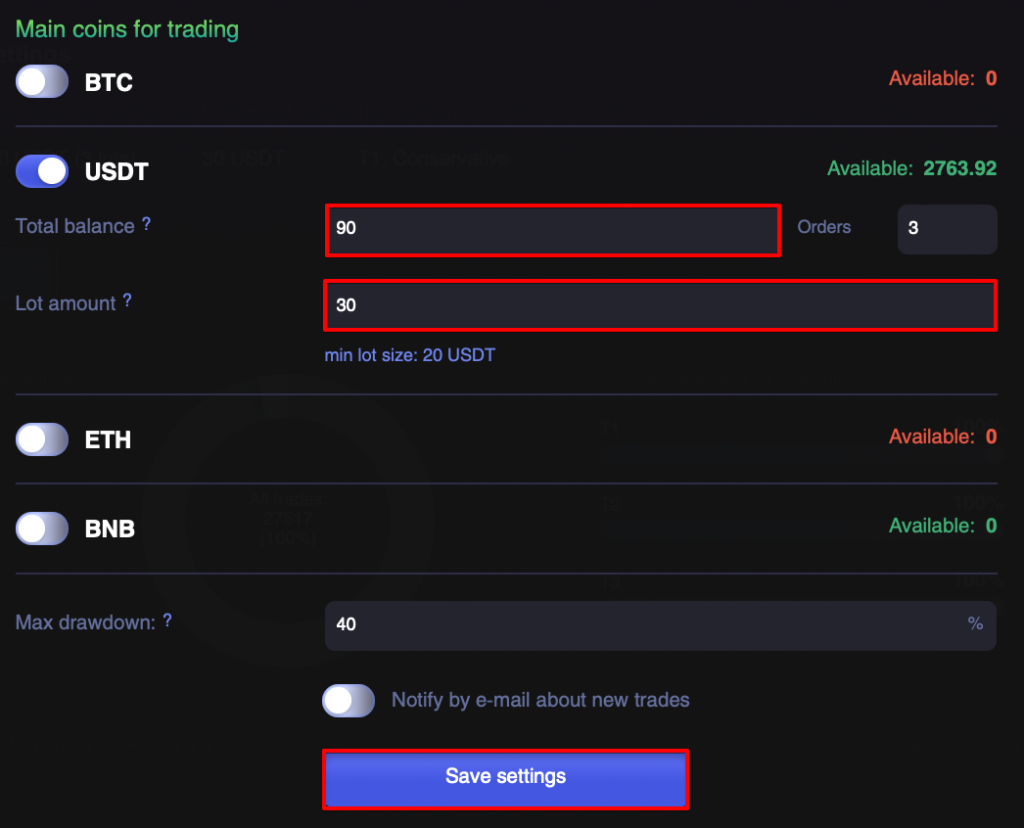

- First of all, you need to select the exchange API key you want to launch Autofollowing on.

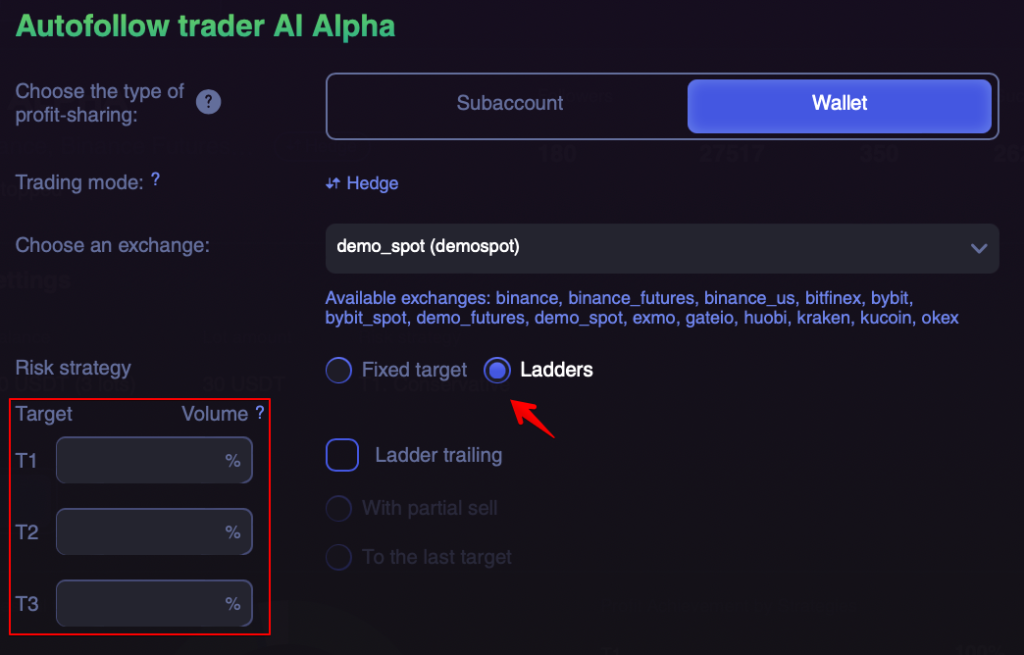

- Then you need to choose one of two options for exiting trades:

- Exit on a fixed target. This means that You can choose only one target out of 3 to exit the trade.

- Ladder exit (with partial sale). You can choose multiple targets simultaneously to exit the trade or pull the trade up to the last target. In the left part of the block, allocate the targets for the partial sale by shares. The sum of % for all 3 targets must equal 100%.

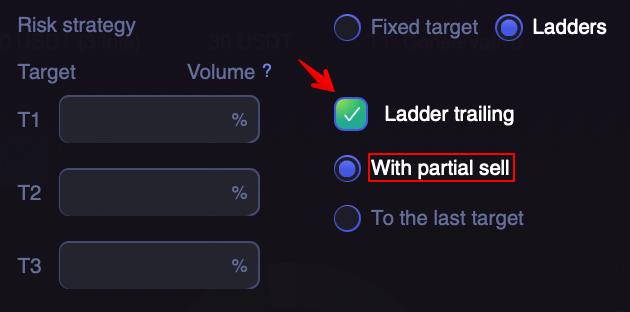

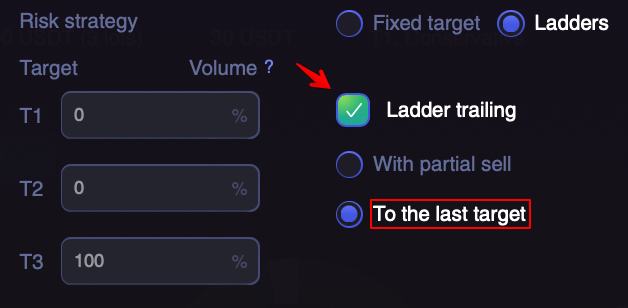

- Next, you can switch on Ladder Trailing. The Ladder Trailing checkbox is used to adjust the Stop Loss level when each new target is reached.

SL controls the selected targets and is adjusted according to the target achievement rule:

When reaching T1 -> SL= break-even, T2 -> SL=T1, T3 -> SL=T2.

This function has 2 subsets:

- With partial sell. Trade amount will be split into 3 parts, according to the specified Volume. The trade will be closed for each of the targets gradually.

- Trailing to the last target. Only one target (the last one) is monitored for a trade exit, and a trade will be closed for 100% of the volume.

The analyst can also set recommended parameters for settings. The recommended parameters will be marked with a blue caption and selected by default.

4. After that you need to select:

- Main coin which you plan to trade to, BTC, USDT, ETH (you can choose all 3, you can choose 2 or 1) — most often signals are provided to USDT. It is important to study the channel statistics and choose the one or those coins that are given signals in this channel;

- Balance that you allocate to trade (after selecting the exchange you will see the balance available for this key in the selected currency);

- Size of one lot (in the selected currency) or the number of lots. For risk management it is recommended to divide the balance into at least 10 parts;

- Maximum leverage (for futures exchanges only).

5. Click the Save and Start button.

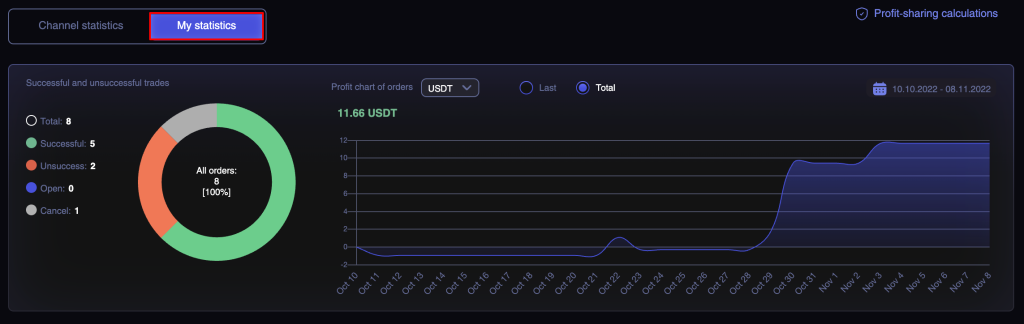

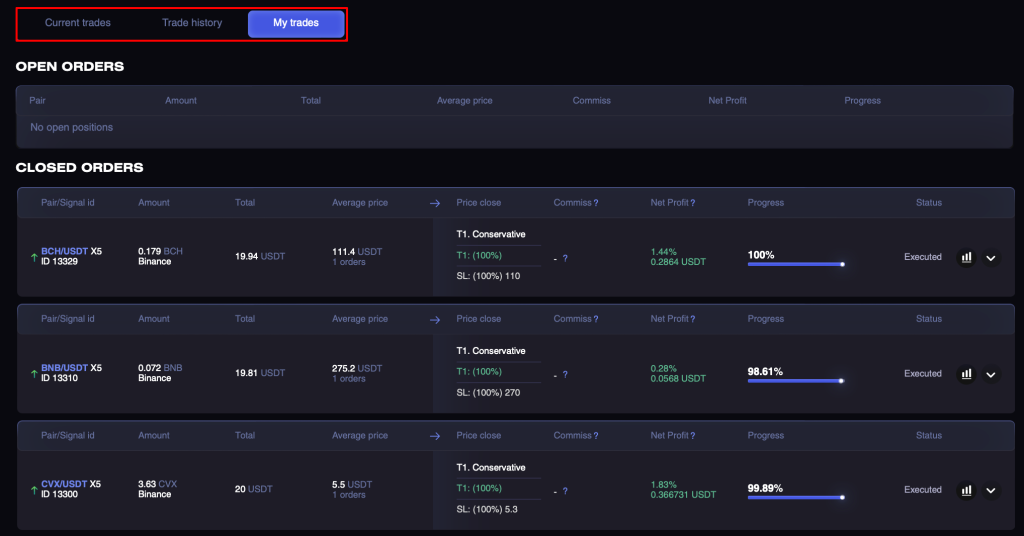

After making the first trades, data on your trades will appear in the My statistics section:

- settings that are currently implemented to the Autofollowing on this channel;

- Win/Loss charts and cumulative revenue chart;

- statistics for each of the trades.

In order to diversify your portfolio you can subscribe to several channels and earn income from different signals, or afterwards choose the most profitable channel for yourself.